Mastering Financial Modelling, Analysis & Valuation

Mastering Financial Modelling, Analysis & Valuation

Mastering Financial Modelling, Analysis & Valuation – Become a Certified Financial Analyst

The demand for professionals who can create and evaluate financial models is on the rise in the finance sector. Whether you are a finance professional aiming to advance your career or a beginner looking to break into the field, mastering financial modelling and valuation can be challenging. Enrolling in the Financial Modelling and Valuation Analyst program helps you overcome these challenges by providing a strong foundation in complex financial concepts, hands-on experience, and effective financial data management.This is an ideal choice if you're looking to Learn Financial Modelling in India with globally recognized skills.

What Do We Offer?

Empirical Academy's Financial Modelling and Valuation Analyst course is designed to simplify this learning process. It offers structured, practical financial analysis skills that employers actively seek. Through this course, you will acquire both fundamental and advanced skills, empowering you to interpret financial data, perform valuations, and make informed investment decisions. The curriculum combines theoretical knowledge with practical learning, enabling you to confidently apply financial concepts in real-world situations.From a finance enthusiast, MBA student, to working professional, this is one of the top Financial Modelling Courses for Beginners.

Key Features of the Financial Modelling Valuation Analyst Course In-Depth Curriculum

The course is structured to cover both the theoretical and practical aspects of financial modelling and valuation. You’ll learn to build accurate models, perform valuations, and interpret complex financial data. It also includes modules on Excel for Financial Modelling which is widely used in investment banking.

Hands-On Experience

Financial modelling case study

projects offer practical experience. This allows you to build proficiency in analyzing financial statements, forecasting future earnings, and performing discounted cash flow (DCF) analysis.

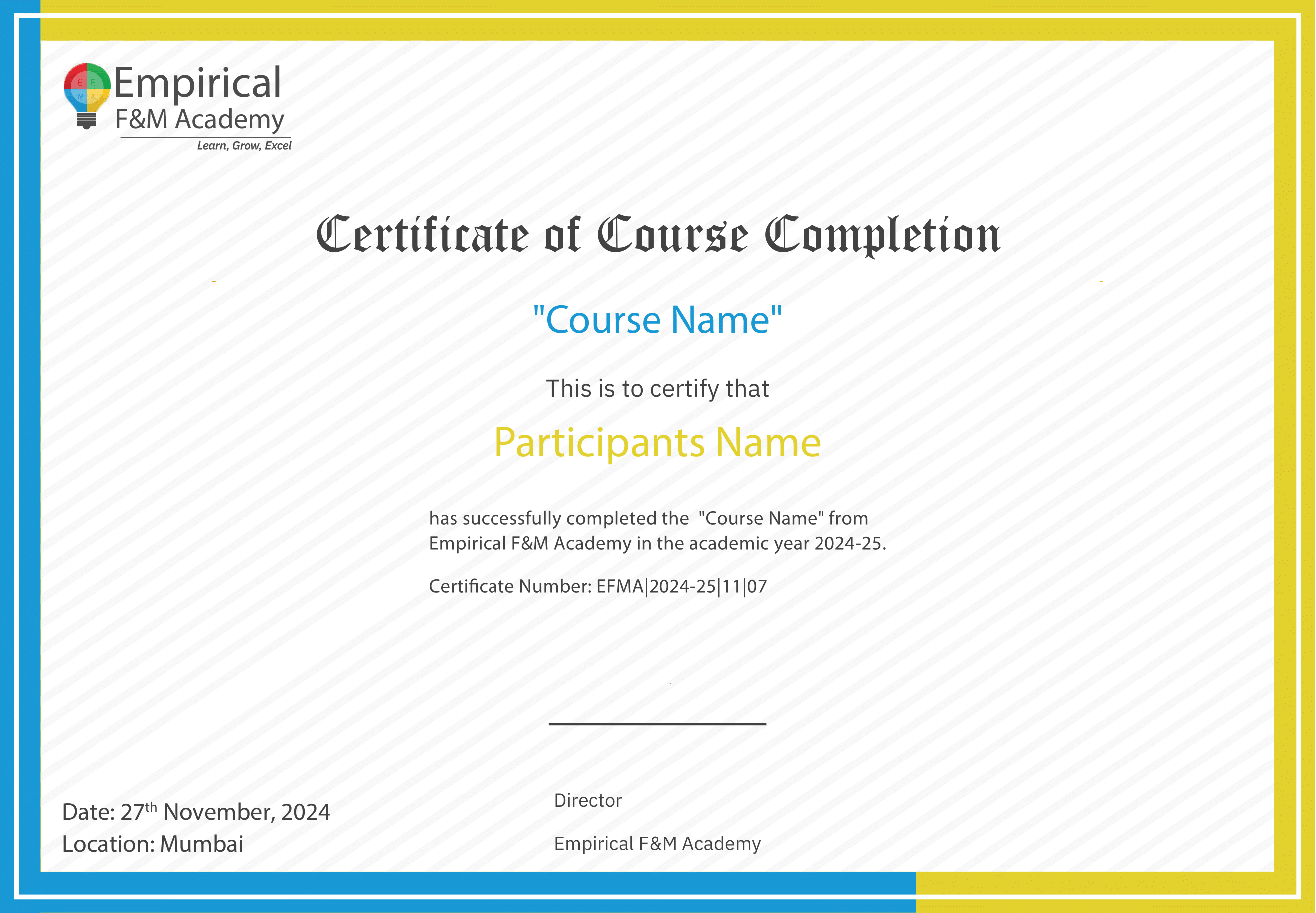

Financial Modeling & Valuation Analyst Certification

Upon successful completion of the course, you’ll receive a recognized certification that showcases your financial modeling and valuation skills. This Financial Modelling Certification in India is a trusted credential among top finance employers.

Flexible Learning

It's one of the most practical options if you're seeking a Financial Analyst Course Online with flexibility. You can learn at your own pace through our online learning programs.

Expert Instructors

Learn from industry professionals with years of experience in finance. Our instructors offer practical insights and guidance to help you get the most out of your learning sessions.

Benefits of Becoming a Financial Modelling Valuation Analyst

Career Advancement.

The Financial Modelling & Valuation Analyst program improves your profile, opening doors to roles in investment banking, equity research, and corporate finance, where you can assess financial performance and investment potential. If you’re looking for an Investment Banking Course with Valuation training, this program delivers both.

Hands-On Experience

Gain practical experience by working on financial modelling case studies, building confidence to tackle practical financial challenges.

Improved Decision-Making

Mastering financial modelling and valuation empowers you to make precise financial decisions, from evaluating performance to forecasting cash flows and identifying investment opportunities.

Increased Earning Potential

Equipped with these specialized skills, you’ll qualify for higher-paying roles with better career growth, as financial modelling and valuation experts are highly sought after.

Eligibility For Financial Modelling and Valuation Analyst Course

- Beginners

- Mid-Career Professionals

- Experienced Traders

- Finance Students

Choose Empirical Academy for Your Financial Modelling Education

Empirical Academy is a leading provider of high-quality financial training. Our courses align with current industry practices and combine theory with practical learning, making them perfect for both beginners and experienced professionals.

Empirical Academy’s Mastering Financial Modelling, Analysis & Valuation course is your gateway to mastering real-world finance. Designed by experienced financial analysts, this program covers financial modeling, corporate valuation, and deep analytical tools using Excel – all taught live with hands-on support.

Learn how to structure robust financial models, forecast performance, and evaluate businesses just like investment bankers and equity researchers.

Along with our Financial Modelling Valuation Analyst course, we also offer training in areas like Technical Analysis, Fundamental Analysis, Stock Valuation, Intraday Trading and many more. With flexible online learning options and ongoing support, we ensure you gain the skills necessary to excel in the finance industry.

Will you get Certified?

Mr. Chirag Jain is a CA, CFA & Company Secretary. He has over 10 years of experience in the Indian Financial Markets and he had been associated with National Stock Exchange of India Limited for a period of 7 years and had an exposure in Investigation and Surveillance activities of securities market and also conducted forensic investigation of various listed companies.

Currently he provides Corporate Advisory Services and helps his clients in making proper investment decisions.

Along with practicing as a CA currently, he has been an active trainer in the subject of Fundamental Analysis, Equity Research, Derivatives, Risk Management etc with NSE Academy and Empirical Academy and also personally imparts training to various individual, students, businessman, corporate etc. on fundamental analysis and guiding them in making informed decisions.

Our Recent FAQS

Frequently Asked Question &

Answers Here

What will I learn in the Financial Modelling Valuation Analyst course?

You will learn how to build financial models, perform company valuations using techniques like DCF and comparable company analysis, and apply these concepts practically with financial modelling case study exercises.

How does the course integrate financial modelling case study projects?

The course includes financial modelling case study projects that provide hands-on experience, allowing you to solve real business challenges using financial modelling techniques.

How does this course benefit beginners?

This course is beginner-friendly, starting with foundational financial modelling and valuation concepts, and progressing to advanced topics to ensure comprehensive knowledge.

Can this course help me advance my career?

Yes, the Certified Financial Modeling & Valuation Analyst program equips you with in-demand skills that can lead to high-paying roles and career advancement in various finance sectors.

Copyright © By Empirical F&M Academy. Design & Developed by Techno Duniya

.jpg)

.jpeg)