U.S. ADP Jobs Report Signals Cooling Growth — What It Means for India

U.S. ADP Jobs Report Signals Cooling Growth — What It Means for India

Context & Highlights

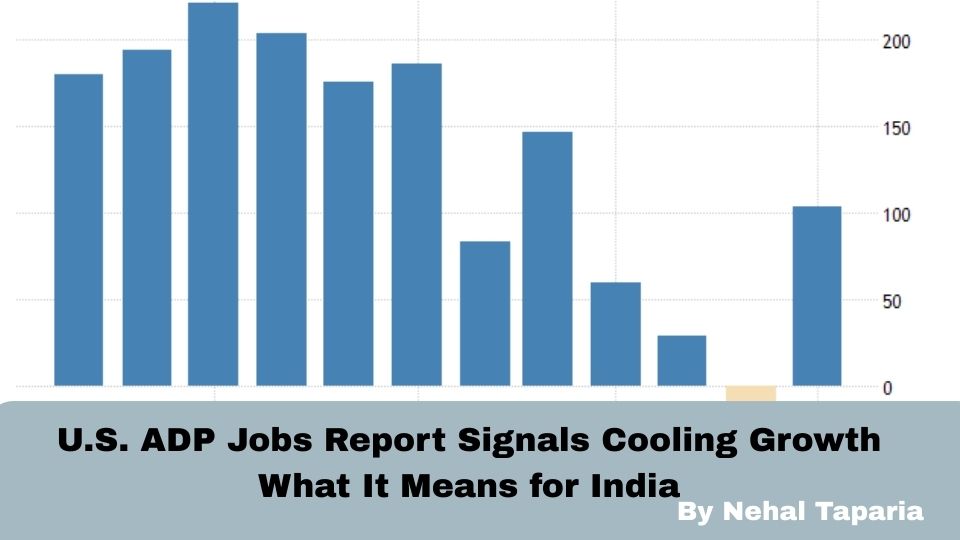

On September 4, 2025, ADP reported only 54,000 net private-sector jobs added in August—well below the ~73,000 forecast.

Market expectations hovered around 68,000 jobs, with ADP data widely seen as an early indicator ahead of the official U.S. Nonfarm Payrolls (NFP) release.

Historically, weak employment numbers like this prompt speculation about monetary easing—the U.S. Federal Reserve might be nudged toward rate cuts.

Why It Matters Globally

Job strength reflects economic resilience; weaker hiring has ripple effects on global risk sentiment.

Markets often react sharply to unexpected data—currencies, equities, and commodities adjust swiftly.

In such contexts, gold often benefits (rising prices), while the U.S. dollar may weaken—both key for emerging markets like India.

Implications for the Indian Market

1. Currency & Export Competitiveness

A softer U.S. dollar, triggered by dovish Fed bets, can strengthen the Indian rupee, easing import costs (e.g., oil) while potentially reducing export competitiveness.

2. Equities & Capital Flows

Indian stocks, especially in IT and pharma, could benefit from renewed global risk appetite and favorable currency dynamics.

However, investors might rotate toward U.S. assets if rate cuts boost U.S. equities—India could see some outflows.

3. Commodities & Inflation

A stronger rupee and global easing may ease pressure on commodity prices, potentially tempering Indian inflation and easing room for RBI policy.

4. Policy Outlook

India’s central bank might assess the evolving global liquidity environment—particularly if the U.S. pivots to easing—when charting its own policy course.

Wrap-Up

The 54,000 jobs added reading underscores a cooling U.S. labor market, potentially fueling calls for Fed rate cuts. For India, the resulting global liquidity boost, currency shifts, and investor sentiment swings could prove decisive—offering both opportunities and challenges across sectors.

By Nehal Taparia

This content is for educational and knowledge purposes only and should not be considered as investment or Trading advice. Please consult a certified financial advisor before making any investment or Trading decisions.

Our Recent FAQS

Frequently Asked Question &

Answers Here

What is ADP Nonfarm Employment Change?

A monthly survey by ADP measuring private-sector employment growth in the U.S., released two days before the official BLS NFP report.

How accurate is it?

Why does it move markets?

What’s India’s exposure?

Copyright © By Empirical F&M Academy. Design & Developed by Techno Duniya

.jpg)

.jpeg)