Blog List

Blog List

Trump’s Tariffs Could Reduce India’s GDP by 0.5%: Implications and Strategic Responses

The global trade landscape has been significantly altered by U.S. President Donald Trump's recent decision to impose a 50% tariff on Indian exports

Trump's Escalating Sanctions on Russia: Implications for India's Economy

U.S. President Donald Trump has signaled readiness to escalate sanctions against Russia, particularly targeting nations, including India, that continue to purchase Russian oil. This move marks a significant shift in U.S. foreign policy and has potential ramifications for India's economy.

Can Fed Rate-Cut Optimism and Global Cues Revive Indian Markets Next Week?

Last week, Indian benchmarks remained largely range-bound. The Nifty ended marginally higher by ~6.7 points at 24,741 — securing a weekly gain of about 1% — while the Sensex slipped slightly to 80,710.76.

U.S. Jobs Report (August 2025) & Its Impact on the Indian Market

The U.S. labor softness strengthens speculation that the Fed will initiate rate cuts starting mid-September—reportedly planning two or three cuts this year.

Indian Oil Treads New Waters—US Out, Nigeria & UAE In

On September 5, 2025, Indian Oil Corporation (IOC), the nation’s top state refiner, discontinued its purchase of U.S. crude oil in its latest tender.

Apple's $9 Billion India Boom: Retail Expansion, Factory Growth, and a Jobs Surge

For the fiscal year ending March 2025, Apple’s sales in India surged to a record $9 billion—a 13 % leap from the prior year’s $8 billion. iPhones were the primary driver, with MacBook demand also climbing strongly. This momentum comes amid a plateauing global device market and uncertainties in China.

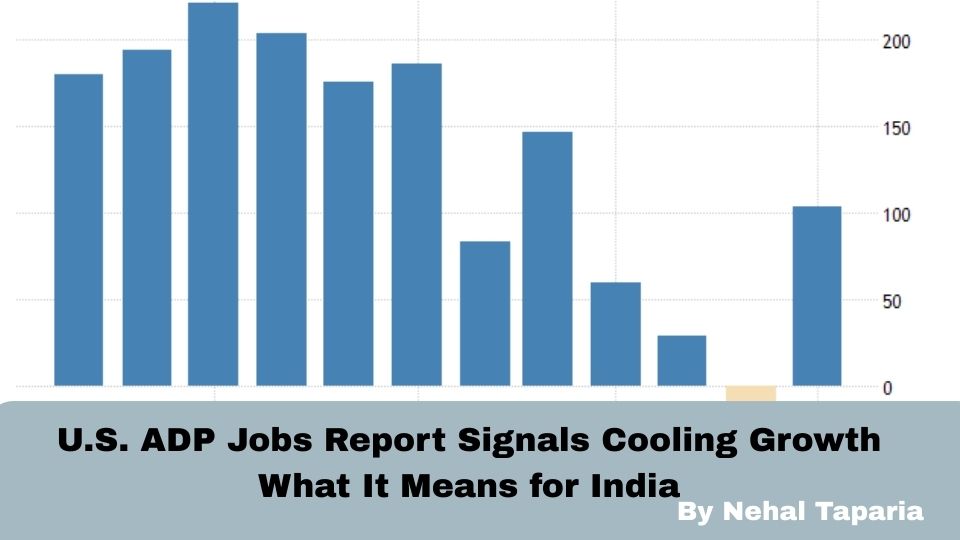

U.S. ADP Jobs Report Signals Cooling Growth — What It Means for India

On September 4, 2025, ADP reported only 54,000 net private-sector jobs added in August—well below the ~73,000 forecast.

India's ₹48,000 Crore GST Gift—A Game Changer for Markets and Growth

On September 4, 2025, India witnessed a landmark reform as the GST Council, under Finance Minister Nirmala Sitharaman, completed what Prime Minister Modi had promised on Independence Day: a sweeping overhaul of the GST regime with an estimated fiscal impact of ₹48,000 crore.

Copyright © By Empirical F&M Academy. Design & Developed by Techno Duniya

.jpg)

.jpeg)